who pays sales tax when selling a car privately in michigan

Gifting the car and she will need to pay sales tax on the cars actual market value. Complete the Title Transfer Application.

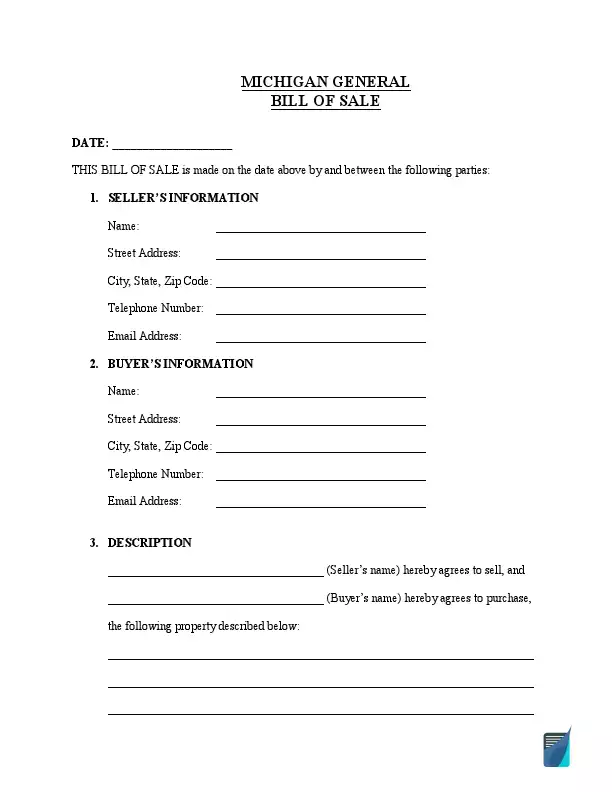

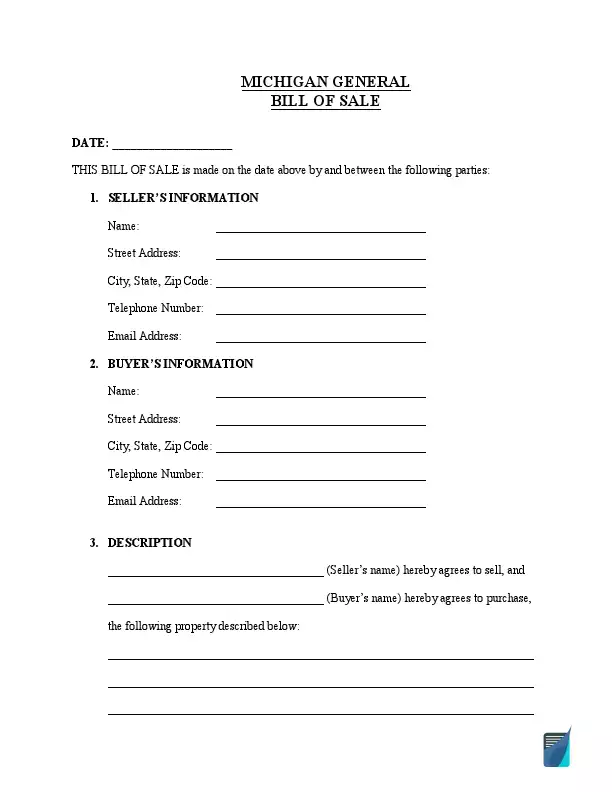

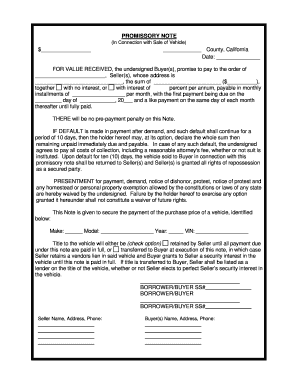

Free Michigan Bill Of Sale Form Pdf Template Legaltemplates

Although the Secretary of State levies a 6 tax on the transfer of title the final determination of the vehicle transfer tax is made by the Michigan Department of the Treasury.

. Find out more about the out of state car title transfer process in Michigan today. Do not let a buyer tell you that you are supposed to. Income Tax Liability When Selling Your Used Car.

If you sell it for less than the original purchase price its considered a capital loss. 2018 Taxes and Business Vehicles. Before the Tax Cuts and Jobs Act you could trade a business vehicle tax-free under Section 1030.

If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid State Form 48842. However the new law eliminates that option so your only choice. The tax rate is 6 of the purchase price or retail value at the time of transfer whichever is greater.

Buy for 40 at amazon. For example a 15000 car will cost you 99375 in state sales tax. That tax rate is 725 plus local tax.

However you do not pay that tax to the car dealer or individual selling the car. Private vehicle transactions in Michigan require a 6 tax due on the full purchase price or fair market value of the vehicle whichever is greater. This means you do not have to report it on your tax return.

Tax owed on all vehicle transfers. The buyer must pay any sales taxes when the new title is applied for or provide proof that the sales taxes have been paid. If the final determination of tax liability differs from the amount collected when the title is transferred the purchaser must pay the difference plus interest and.

It depends on the length of the permit. Whether the car is purchased used or new. If you decide to purchase your new car from a private seller in another state your home state will collect the necessary sales tax once you register the vehicle.

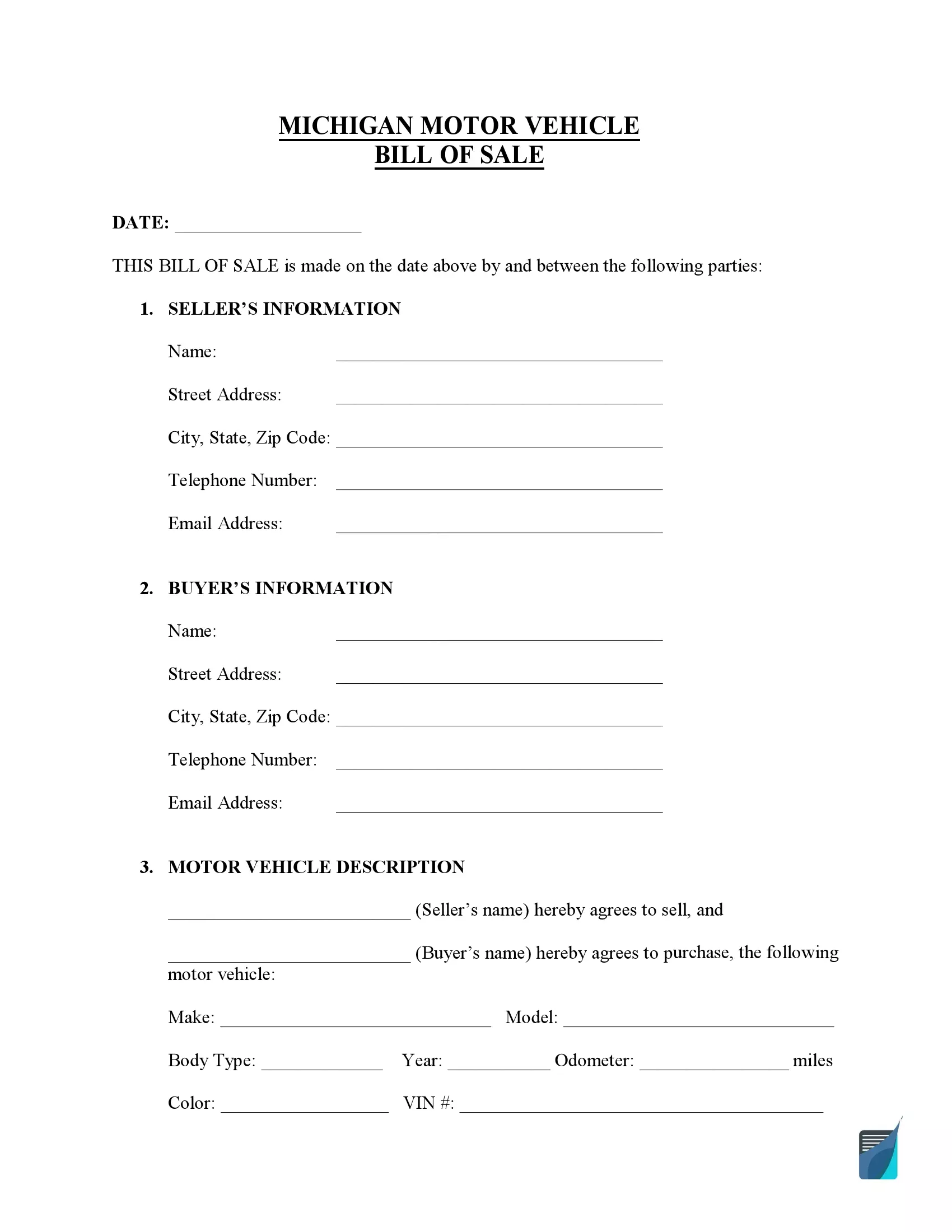

In addition to taxes car purchases in Michigan may be subject to other fees like registration title and plate fees. When you visit your local Department of Motor Vehicles DMV you will need to produce the out-of-state title and the bill of sale from the seller. Proof of Sale Once a car is sold between parties in Michigan the seller is protected from any damages caused by the.

Sales tax varies by state but overall it will add several hundred or even a thousand dollars onto the price of buying a car. In order to ensure a smooth transition for retailers whose only obligation to collect Michigan sales tax comes from these new standards a remote seller must register and pay the Michigan tax beginning with transactions occurring on or after October 1 2018 or the calendar year after the threshold of over 100000 in Michigan sales or 200 transactions with Michigan customers is. In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Out-of-State Title Transfers in Michigan After Buying or Selling a Vehicle. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. In cities like Detroit.

How Much is the Average Sales Tax Rate on Cars. If you purchase a used Honda Civic for 10000 you will have to pay an. Who pays sales tax when youre selling a car privately.

If you want to prevent your daughter from potentially facing a large sales tax bill consider gifting a. However if you sell it for a profit higher than the original purchase price or what is. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the.

The average sales tax rate on vehicle purchases in the United States is around 487. One of the most important things to keep in mind when selling a used car across a state border is that youll have to go through with a title transfer application at both your local DMV and the DMV in the state in which the car will arrive. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets.

Now its time to sell it. If you are legally able to avoid paying sales tax for a car it will save you some money. Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery.

For example sales tax in California is 725. The tax on the transfer of a vehicle is 6 percent on the greater of the purchase price or the retail value of the vehicle at the time of transfer. But permits valid 30 days cost 10 of the annual registration fee or 20 whichever is higher.

Instead the buyer is subject to Michigan use tax when registering the title with the Michigan Secretary of State office. Begin by visiting your DMV and obtaining a paper copy of the. Under Michigan SalesUse Tax Statutes a casual seller ie not a licensed new or used vehicle dealer is not responsible for collecting and remitting sales tax on the sale of a used motor vehicle.

You have all the information you need to sell your car. The Michigan Department of Treasury administers the collection of the tax. However certain states have higher tax rates under certain conditions.

Existing state residents who have purchased an out-of-state vehicle will also be required to pay the 6 percent use tax of the vehicle sale price. You can find these fees further down on the page. Indiana residents who purchased a vehicle from a.

To calculate how much sales tax youll owe simply multiple the vehicles price by 006625. However you do not pay that tax to the car dealer or individual selling the car. No taxes are due if you purchase or acquire a vehicle from an immediate family member.

August 1 2016 CPAs Business Consultants. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. The most expensive standard sales tax rate on car purchases in general is found in California.

And permits valid 60 days cost 20 of the annual registration fee or 40 whichever is more. If a vehicle is purchased privately the sales tax must be paid at a branch when you apply for the Indiana certificate of title. You will pay it to your states DMV when you register the vehicle.

The buyer will have to pay the sales tax when they get the car registered under their name. Michigan collects a 6 state sales tax rate on the purchase of all vehicles. You can sell your daughter a car for 1 if you want but you dont save much work vs.

What S The Car Sales Tax In Each State Find The Best Car Price

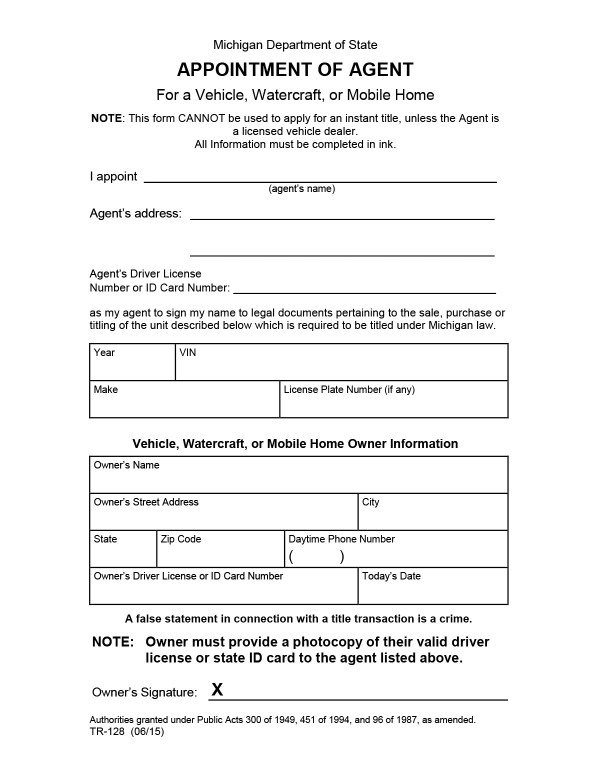

How To Transfer A Car Title In Michigan Yourmechanic Advice

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Michigan Bill Of Sale Forms Information You Need To Create A Bill Of Sale

Car Sales Tax In Michigan Getjerry Com

Nj Car Sales Tax Everything You Need To Know

/buying-a-car-in-a-different-state-4148015-Final2-1a901895477c4c518d48407644568ce8.png)

Tips For Buying A Car In A Different State

Car Tax By State Usa Manual Car Sales Tax Calculator

Free Michigan Bill Of Sale Forms Mi Bill Of Sale Templates

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

Michigan Sales Tax Small Business Guide Truic

Free Michigan Motor Vehicle Dmv Bill Of Sale Form Pdf

Michigan Sales Tax On The Difference For Trade Ins Means More Money For You

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

![]()

Free Michigan Bill Of Sale Forms Pdf Word

Michigan Title Transfer Seller Instructions Youtube

Free Michigan Bill Of Sale Forms Mi Bill Of Sale Templates

13 Printable Vehicle Purchase Agreement With Monthly Payments Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller