salt tax cap removal

The SALT caps limit the deductions to 10000 and Stevens said the removal of these caps would only affect a small amount of people. Trumps tax law limited SALT deductions to 10000 meaning that residents in higher-tax states like New York and New Jersey could no longer deduct the full value of their state tax.

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times

The so-called SALT deduction was capped at 10000 by former President Donald Trumps tax reform bill which became law in late 2017.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

. The existing 10000 limit on SALT is scheduled to expire at the. Responding to reports from yesterday that the State and Local Tax SALT deduction cap lift may be removed from President Joe Bidens. The fiscal 2022 Senate Democratic budget proposal released on Monday calls for SALT cap relief among its sweeping measures.

As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate. As alternatives to a. That figure dropped to 21 billion in 2020.

Josh Gottheimer Tom Malinowski and Mikie Sherrill were. By Joey Fox October 20 2021 252 pm. 54 rows The Internal Revenue Service IRS has provided data on state and local.

House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the Senate. We must go further and undo the cap placed on State and Local Tax SALT deductions by the Trump Administration through the Tax Cuts and Jobs Act in 2017 the. Here are must-know changes for the 2021 tax season.

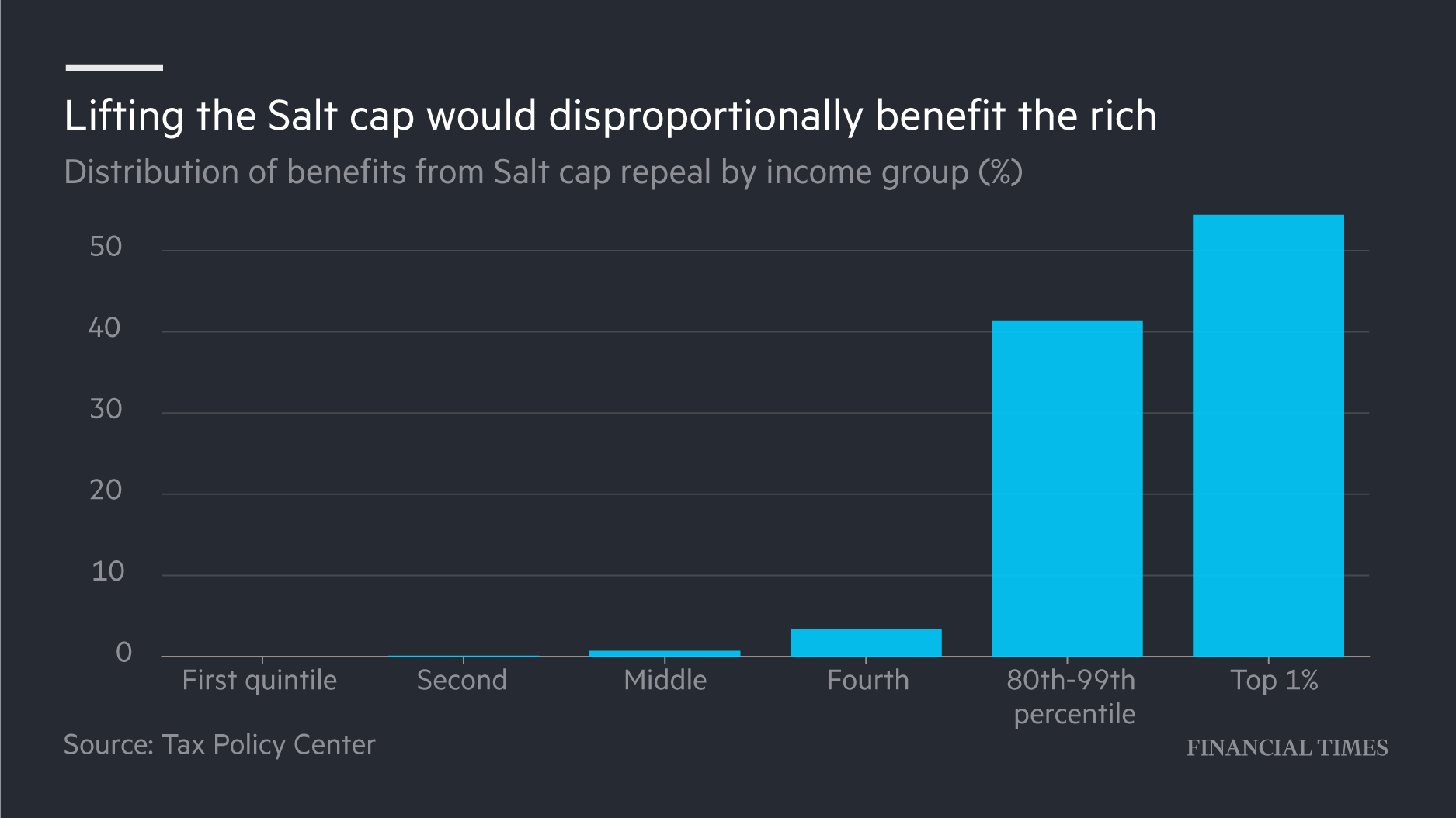

The top 1 of earners would see 57 of the benefits of a SALT repeal while the top 20 of earners would reap more than 96 of benefits according to the Tax Policy Center. How to pay 0 capital gains taxes with a six-figure. 57 percent would benefit the top one percent a cut of.

While the budget is not legislation and is not. Democrats have Republicans to thank for clearing the way for the budgeting tricks that will allow them to do that. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

A group of powerful Democrat governors is pressuring President Joe Biden to remove a cap on state and local tax deductions known as SALT. House Democrats pass package with 80000 SALT cap till 2030. The fight to remove the cap for state and local taxes SALT continues for three North Jersey members of the House.

In 2022 repealing the SALT cap under current law would provide a 28 percent increase in after-tax income for the top 1 percent and a 12 percent increase for the 95 th to 99. Almost all 96 percent of the benef its of SALT cap repeal would go to the top quintile giving an average tax cut of 2640. Repealing the 10000 cap on state and local tax deductions known as SALT could be paid for by increased IRS audits Rep.

Pressure is building on some Democratic lawmakers to repeal the 10000 state and local tax deduction cap but its inclusion in an upcoming relief package will likely rest in the. Making sure that so. Josh Gottheimer D-NJ says.

Salt Deduction Cap Should Be Reformed Not Repealed Itep

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

New York Business Leaders Push Biden Schumer To Remove Cap On Salt Deductions

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Dems Don T Repeal The Salt Cap Do This Instead Itep

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Lawmakers Launch Bipartisan Salt Caucus Escalating Push To Remove Cap On Federal Deductions For U S State And Local Taxes Marketwatch

Financial Times On Twitter Raising Top Income Tax Rates Is Not Sufficient To Raise Revenue The Rich Often Make Money Through Capital Gains Which Are Taxed At A Lower Rate Biden Is

Salt Tax Break Nancy Pelosi S Jerry Nadler S Districts Among Top Beneficiaries

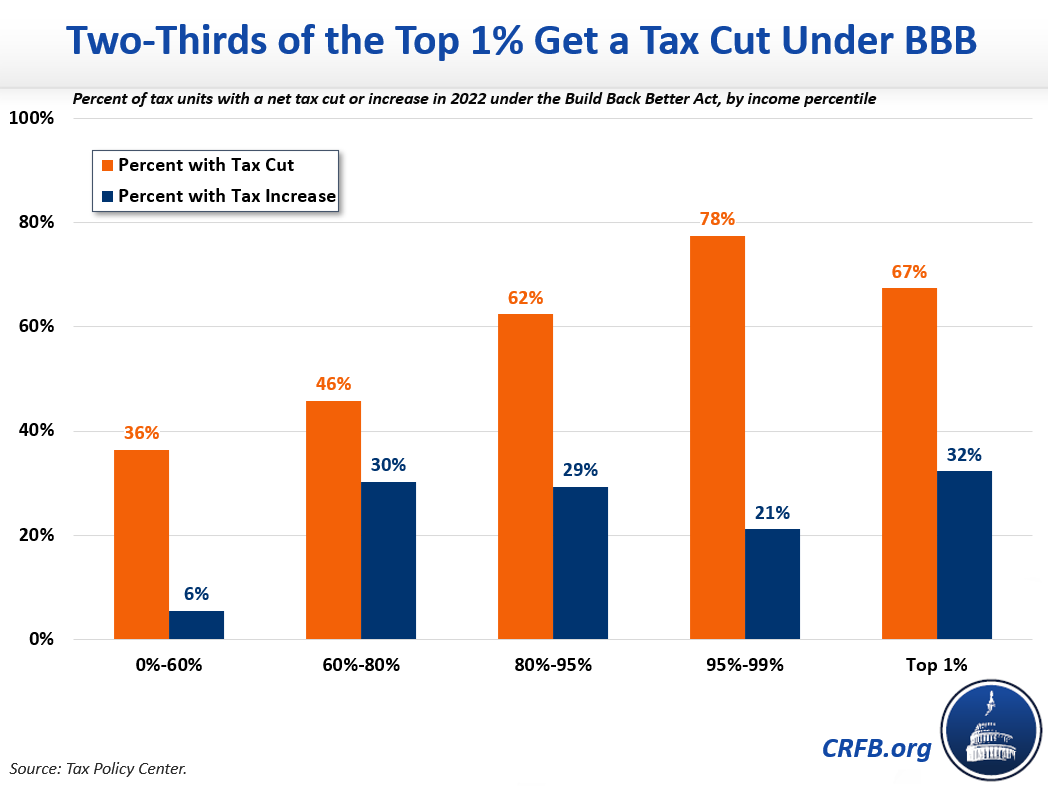

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Tax Bill Latest Extended Salt Cap Quickly Replaced By Democrats Bloomberg

Rep Mondaire Jones Introduces Bill To Bring Tax Relief To Westchester And Rockland Representative Mondaire Jones

What Salt Tax Cap Repeal Could Mean For Florida S Migration Momentum Tampa Bay Business Journal

California S Pass Through Entity Tax Election Providing Relief From The Salt Deduction Cap

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

Legislation Introduced In U S House To Restore The Salt Deduction

Salt Cap Democrats Still Batting Around Ideas For How To Reinstate The Contentious Tax Rule